Pricing Your Home to Sell

Pricing Your House to Sell Can Be Tricky

by The KCM Crew on September 11, 2013

- //

The housing market is finally recovering. Sales are up and so are prices. That means good news for anyone thinking about selling. However, we must be careful not to fall into the trap of over exuberance. Pricing a house incorrectly when it is first listed for sale can be a huge mistake.

Ken H. Johnson, Ph.D. at Florida International University and Editor of the Journal of Housing Research, referring to previous research by John Knight, revealed:

“Sellers as well as Brokers/Agents should therefore be aware of the critical necessity of getting the price correct from the start. Sellers wanting to over list will ultimately take longer to sell and will sell their property for less, on average, according to Knight. Brokers/Agents’ desire to take a listing and get the price right later will ultimately lead to their working harder according to Knight, and they are not doing their sellers any favors.”

Why Are We Bringing This Issue Up Now?

Recent price increases seen in housing have been the result of a lack of salable housing inventory across the country. This inventory challenge is beginning to correct itself and many believe that price increases will begin to taper off.

Bill McBride, the author of the renowned economic blog Calculated Risk, explains:

“I think that inventory bottomed earlier this year, and that the NAR will report a year-over-year increase in inventory very soon (probably for September). As more inventory comes on the market, buyer urgency will wane and price increases will slow and even decline seasonally in many areas this winter.”

If you are putting your house on the market, make sure you consult with me before establishing your price. That is the only way you can guarantee getting top dollar in this market.

Search for your next home at www/JKRealtyTeam.com

5 Reasons to Sell Now

Thinking of Selling Your House? 5 Reasons to Do it Now

by The KCM Crew on September 10, 2013 · 1 comment

in For Sellers, Pricing//

Many now realize that it is a great time to buy a home. Today, we want to look at why it might also be an opportune time to sell your house. Here are the Top 5 Reasons we believe now may be a perfect time to put your house on the market.

1.) Demand Is High

The most recent Existing Home Sales Report by the National Association of Realtors (NAR) showed a 17.2 percent increase in sales over July 2012; sales have remained above year-ago levels for 25 months. There are buyers out there right now and they are serious about purchasing.

2.) Supply Is Beginning to Increase

Total housing inventory last month rose 5.6% to 2.28 million homes for sale. This represents a 5.1-month supply at the current sales pace, compared with 4.3 months in January. Many expect inventory to continue to rise as 3.2 million homeowners escaped the shackles of negative equity in the last 12 months and an additional 1.9 million are expected to enter positive equity in the next 12 months. Selling now while demand is high and before supply increases may garner you your best price.

3.) New Construction Is Coming Back

Over the last several years, most homeowners selling their home did not have to compete with a new construction project around the block. As the market is recovering, more and more builders are jumping back in. These ‘shiny’ new homes will again become competition as they are an attractive alternative for many purchasers.

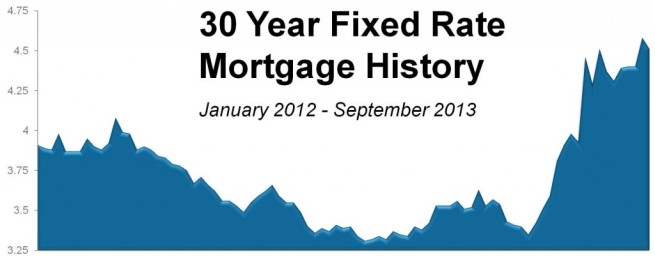

4.) Interest Rates Are Rising

According to Freddie Mac’s Primary Mortgage Market Survey, interest rates for a 30-year mortgage have shot up to 4.57% which represents a jump of more than a full point since the beginning of the year. The Mortgage Bankers Association, Fannie Mae, Freddie Mac and the National Association of Realtors are in unison projecting that rates will continue to climb.

Whether you are moving up or moving down, your housing expense will be more a year from now if a mortgage is necessary to purchase your next home.

5.) It’s Time to Move On with Your Life

Look at the reason you are thinking about selling and decide whether it is worth waiting. Is the possibility of a few extra dollars more important than being with family; more important than your health; more important than having the freedom to go on with your life the way you think you should?

You already know the answers to the questions we just asked. You have the power to take back control of your situation by putting the house on the market today. The time may have come for you and your family to move on and start living the life you desire. That is what is truly important.

Find your next home at www.JKRealtyTeam.com

Above is a graph of the movement of the 30 year fixed mortgage rate since the beginning of 2012.

Some buyers are waiting to see if interest rates will come back down before making a decision about buying a home. Though no one can guarantee where rates will be in a few months, we don’t believe waiting is a good strategy.

Most experts believe rates may actually move higher. The Mortgage Bankers Association, Fannie Mae, Freddie Mac and the National Association of Realtors are in unison projecting that rates will continue to climb.

With home prices increasing and interest rates projected to also increase, the cost of buying a house could quickly increase rather dramatically.

Find your next home at http://www.JKRealtyTeam.com

The Best time to buy? RIGHT NOW!

After witnessing the housing bubble ‘pop’ just a few years ago, many would be buyers may be hesitant to pull the trigger. Today, we want to explain that the greatest risk a buyer can take right now is actually waiting to buy a home.

We realize that every purchaser wants to be able to get the best deal. They want a great price and the lowest mortgage interest rate possible because those to items together will determine the monthly cost their family will pay. Let’s look at each one:

Are home prices rising?

Just last week, the Case Shiller Pricing Index was released. The index revealed that U.S. home prices increased by 10.2% over the last twelve months. Last month, the Home Price Expectation Survey was released predicting that home values would increase by at least an additional 3.5% for each of the next five years.

If you were waiting for the absolute bottom of the home price declines, you already missed it.

Are interest rates rising?

According to Freddie Mac’s Weekly Primary Mortgage Market Survey, the 30 year mortgage rate shot up to 3.81% last week – the highest level in over a year. This is an increase of a half of a percentage point in the last six months. And the Mortgage Bankers Association, Fannie Mae and the National Association of Realtors all predict that rates will continue rise over the next eighteen months.

Conclusion

If the right thing for you and your family is to purchase a home this year, buying sooner rather than later could lead to substantial savings.

You can find your dream home at www.JKRealtyTeam.com

How’s the Market?

The local real estate market continues to improve. Interest rates remain below 4%. The housing inventory remains low. If you are thinking about selling, this is the time to do it. Please call 630-926-4432 or email Jack@JKRealtyTeam.com to schedule a free market consultation. Looking for a new home? You can search the MLS at www.JKRealtyTeam.com.

| The Week Of March 17 – March 23 | |||||

| Naperville | Aurora | Plainfield | Wheaton | Oswego | |

| New Listings | 51 | 51 | 36 | 15 | 15 |

| Under Contract | 57 | 45 | 28 | 9 | 9 |

| Closed | 19 | 18 | 16 | 10 | 11 |

| Avg Sale Price | 354,365 | 160,538 | 236,976 | 330,780 | 286,690 |

| Avg Days on Market | 102 | 107 | 130 | 205 | 120 |

2012 was a good year for the housing market … well … relatively speaking. According to Freddie Mac, housing prices were up 4% over the past 12 months, which is good. However, they were still down 22% from their high in 2005. As I said, it’s all relative.

Lawrence Yun, chief economist of the National Association of Realtors (NAR), is optimistic though: “Home sales are on a sustained uptrend, mortgage interest rates are hovering near record lows, and unsold inventory is at the lowest level in 12 years.” Yes, the housing market has improved, and, based on the factors below, we can expect the trend to continue in 2013.

Factor 1: Housing Affordability Index

The Housing Affordability Index, which was developed by the NAR, measures the ability of a typical family to qualify for a mortgage on a typical home. According to the NAR, the index is based on “the relationship between median home price, median family income, and average mortgage interest rate.” A measurement of “100” means that a typical family could qualify for a mortgage.

In 2012, the Housing Affordability Index was 193.5—a record high—and, in 2013, it’s expected to average 161. So, household purchasing power is good.

Factor 2: Low Interest Rates

Mortgage interest rates are at record lows. Although they are expected to rise in 2013, they will still be low. (It’s all relative.) For homebuyers, lower rates translate into lower income requirements to qualify for loans, increased borrowing power, and lower monthly payments. Spurred by these benefits, the number of potential homebuyers increases and the demand for housing goes up. For sellers, the demand for housing translates into higher housing prices. It’s a domino effect that’s good for everyone.

Factor 3: Supply and Demand

In the U.S., the annual need for new housing units is approximately 1.5 million (sufficient to accommodate population growth, vacation homes, and demolition). In 2005, at the height of construction, 2.5 million units were built, which glutted the market. By contrast, in 2012, less than half the annual need (slightly over 600,000 units) was built. According to Freddie Mac, housing oversupply is at its lowest in over a decade. As a result, the supply and demand in the housing market has become more balanced.

Factor 4: Buy vs. Rent

During the recent financial crisis, families were forced out of their homes and into rental properties. As predicated by the law of supply and demand, rents increased, and apartment owners experienced a mini boom. Today, in some cities, rents are so high and housing prices are so low that it is cheaper to buy than it is to rent. So families are once again making the move to homeownership.

Experts agree that the housing market is improving—the upward trend is there. Forecasts for 2013 are positive, and we can expect another good year for the housing market … relatively speaking.

Search the MLS on my website at www.JKRealtyTeam.com. If you are thinking about buying or selling a home, please call me at 630-926-4432 or email Jack@JKRealtyTeam.com

As of last night, the United States Senate and House have passed the 2013 American Tax Payer Relief Act. In section 202, the bill calls for the Mortgage Debt Relief Act to be extended until 1/1/2014.

This is fantastic news for any homeowner who is underwater and needs to sell a property, but was worried about the tax implications of a cancelled debt. Information about the Mortgage Debt Forgiveness Act can be found on http://www.irs.gov/Individuals/The-Mortgage-Forgiveness-Debt-Relief-Act-and-Debt-Cancellation (the news is still very new and the IRS will need time to update their website, but the original information is available on that link).

Homeowners in difficult situations are faced with difficult decisions, whether to walk away from their “promise” and foreclose on the property or to work through a short sale. The Mortgage Debt Forgiveness Act offers homeowners a dignified transition out of their property. In a short sale, they are able to negotiate the terms of the short payoff. In most cases they are able to have the lender(s) forgive their deficiency. Now with an additional tax incentive, it’s really a “no brainer”.

I have a full team of professionals avialable to help you with your short sale. Call me at 630-926-4432.

The leaves are at their peak color, it is getting chilly and winter isn’t too far away. It’s time once again to get your home ready for the coming change of seasons.

On the inside

__ Check smoke detectors: Change your smoke detector batteries, and check for proper operation. Also, check the date on the bottom of the smoke detector. Smoke detectors have a life span, and if yours is more than 10 years old, it may not work properly in a fire, so replace it with a new one. Also, make sure you have a smoke detector at each sleeping room, and one centrally located on each level of the home.

__ Install a carbon monoxide detector: If you have a furnace, fireplace, water heater, or other appliance that’s fueled by propane or natural gas, or if you have an attached garage, install a carbon monoxide detector. They just plug in, and you can get them inexpensively from most home centers and other retailers. If your existing carbon monoxide detector is more than 5 years old, replace it with a new one.

__ Check gas appliances: Speaking of gas appliances, consider having your utility company or heating contractor inspect flues, fittings, and other components of your natural gas or propane appliance and heating systems for potential problems.

___ Change furnace filters: Always put in new furnace filters in the fall. It’s a simple and inexpensive way to add to your home’s efficiency and your family’s comfort.

___ Check and seal heating ducts: Crawl a little, save a lot. Check the ducts in your attic, basement, and crawl space for gaps between ducts and fittings, and seal them with a quality metallic tape, not regular duct tape, which doesn’t last. Also, check to be sure that all of the ducts are off the ground and adequately supported.

___ Check insulation levels: Increased insulation can make a huge difference in both your comfort and your heating bills, so don’t put off having your insulation levels inspected. Call your local utility company or building department to learn what levels are optimum for your area. Check the attic, underfloor, kneewalls, skylight shafts and ductwork. Upgrade underinsulated areas as needed, either as do-it-yourself project (home centers and hardware stores have all the supplies you need) or with the help of a licensed insulation contractor.

Tomorrow we will talk about the outside.

Is The Market Really Recovering?

Whenever I tell someone that I am in real estate, the first thing they ask is if I think the market is getting better. The short answer is yes.

If we dig a little deeper, there are many encouraging signs. Compare March 2011 to March 2012: The number of houses for sale is down 19.9%. The number of properties under contract is up an astonishing 42.5% and the number of properties sold is up18.4%.

Pricing is a different story. Again comparing March 2011 to 2012, the average price of homes sold was down 3% and the list price of homes under contract is down 0.5%. Interestingly, the average list price of homes currently for sale is up 5.5%. That indicates that the homeowners are still not quite in touch with the market.That is confirmed by an increase of average days on the market by 2.3%.

Statistics are good to look at and they are encouraging. But there are other indicators that youcan’t see in the statistics. We are beginning to see multiple offers on well-priced properties and the buyers are becoming less-likely to cancel the sale over inspection issues. They are finally realizing that if they find a home in an area that they like that is in their price range, it is going to have some character.

We still have a way to go. There will be another wave of foreclosures this year that the banks have been holding into for a while. This will keep the prices down but hopefully not push them down much farther.

The affordability index is at its lowest point ever. The means that it takes less of your income to own a home that ever before. So if you have been thinking about buying a home, stop thinking and do it!

You can search the MLS on my website at www.JackKelleyHomes.com.